How to Perform a Test of Your Marketing

Does any of the following sound familiar?

5 min read

Kevin Smith

:

6/12/25 10:35 AM

Kevin Smith

:

6/12/25 10:35 AM

Credit unions have always claimed to put members first. But so does everyone else now, including big banks and fintechs. In a marketplace full of "people over profits" messaging, simply saying you're member-first is no longer a differentiator. It's the minimum expected.

What used to set credit unions apart from big banks has become white noise, as customer-centric language and strategies are now common among large financial institutions, not just community banks or credit unions.

And in today's economic climate, that's a serious challenge. With inflation, high interest rates, and growing financial anxiety, prospective members are more careful than ever about who they trust with their money. They're not just looking for friendly language. They want real guidance, useful tools, and support that helps them navigate uncertain times. Generic messaging isn't enough, and consumers are not opposed to leaving their primary financial institution to find something better.

In this post, we'll explain why "member-first" messaging has lost its edge and, more importantly, what credit unions can do to evolve. The goal isn't to abandon the member-first mindset, but to bring it to life in a way that is specific, tangible, and truly differentiating.

The credit union model was built around the idea that people, not profits, come first. You can find the foundation of this idea in most credit union "About Us" pages. You'll see countless "cigar box" stories about a small group of people, years ago, pooling their money together to provide loans to coworkers or neighbors.

That positioning worked for decades. It helped define the industry and distinguish credit unions from traditional banks. Credit unions also had a built-in advantage: they served specific communities, and were often the most convenient local option.

Fast forward to today. Nearly every credit union tells the same origin story.

The competitive landscape is now flatter than ever. A new bank, credit union, or fintech can be joined online in minutes, and money can be moved by the end of the week. The result is a sea of sameness. Outside of a rate difference, most consumers can't identify what sets one financial institution apart from another.

This is a problem. When everyone is saying the same thing, no one stands out. And worse, it makes everything sound like empty marketing language. That's not just a missed opportunity—it's a brand risk.

In our work with credit unions, we find that today's members want more than broad promises. They expect services and experiences tailored to their needs, behaviors, and goals. Over 50 percent of U.S. consumers expect financial institutions to use their data to personalize experiences. This is especially true for Millennials and Gen Z, who demand relevance at every touchpoint.

TAKE ACTION: Audit your email, app, and website experiences. Are you still sending the same message to everyone? Use behavioral triggers and lifecycle data to tailor offers, content, and financial guidance to each member's journey.

77% of consumers now use digital banking. 66% compare their experience to companies like Amazon and Apple. Your digital experience is not just a support tool. It is a deal breaker. Members will leave for a smoother, more intuitive experience.

TAKE ACTION: Benchmark your digital experience against fintechs, not just other credit unions. Prioritize mobile usability. Eliminate friction in flows like onboarding and loan applications. Treat UX as a competitive advantage, not just a back-office project.

In today's economy, members are looking for meaningful support. Not slogans. High prices, rising rates, and economic uncertainty have created a trust gap. Generic promises don't reassure. They create skepticism.

TAKE ACTION: Look at your homepage, email headers, and campaign messaging. Are you saying, "We're here for you," or actually demonstrating how you're helping people save, borrow smarter, or make informed financial decisions? Lead with clarity and evidence.

Banks and fintechs now use the same "member-first" language. But they're backing it up with real tools, 24/7 support, and AI-driven personalization. In many cases, they're not just saying it better. They're delivering it better.

What They're Doing

Chime offers features like instant transaction alerts and fee-free overdrafts up to $200, improving user experience and building trust.

What Credit Unions Can Replicate

Barriers

How to Overcome

What They're Doing

SoFi offers members budgeting tools, credit monitoring, and spending insights—all powered by personalized data.

What Credit Unions Can Replicate

Barriers

How to Overcome

What They're Doing

Current helps users automate savings with round-ups and personalized goals. It also tracks spending and sends real-time nudges.

What Credit Unions Can Replicate

Barriers

How to Overcome

Not every credit union can leap to this level of personalization tomorrow. But starting with one use case, one segment, or one tool is often enough to show value and justify further investment.

These fintechs are not just promising "member-first" experiences. They are delivering them—through technology, transparency, and proactive service.

Credit unions can compete. But only by proving their value through modern, digital-first member experiences.

Credit unions that rely on generic messaging are losing ground.

Gallup data shows that the engagement premium credit unions once held over banks has dropped from 21 percentage points in 2014 to 11 points today. Net Promoter Scores are falling as well—from 29 points down to 17.

This decline is strongly linked to a lack of digital innovation and overuse of boilerplate messaging. It should be a wake-up call for the industry.

Treat personalization not as a campaign, but as a strategic capability. Start by segmenting members by life stage, behaviors, and engagement level. Use your core and CRM data to trigger relevant experiences across email, mobile, and your website.

QUICK WIN: Launch a new-parent email series based on recent baby-related purchases or account updates

KPI to Track: Click-to-open rate (CTOR) by segment vs. your baseline

If your current systems don't support segmentation, start with one use case. Prove value, then scale.

CMOs don't need more slogans. They need scalable proof of impact. Build an internal "impact library" that collects real member stories using structured forms from branch staff and member services.

QUICK WIN: Feature a recent story in your welcome email series or homepage banner

KPI to Track: Engagement rates for story-driven campaigns vs. traditional messaging

Make story collection a recurring operational task. It's not a campaign—it's content infrastructure.

If your value props are buried on a subpage, they aren't doing their job. Highlight what makes you different—like better loan terms, lower fees, or member-only financial coaching—across your homepage, emails, and onboarding journeys.

QUICK WIN: A/B test a homepage hero with a specific benefit instead of a generic value statement

KPI to Track: Increase in CTA conversion when using differentiator-led messaging

Differentiators should lead, not follow.

If you claim to be member-first, your tech needs to reflect it. Long load times, confusing interfaces, and paper-based processes contradict your message.

Conduct digital experience audits at least twice per year. Map pain points by device, channel, and user intent.

QUICK WIN: Reduce loan app steps, autofill known fields, and eliminate paper wherever possible

KPI to Track: Drop-off rate on high-intent flows like loan applications or new account forms

Poor UX creates brand dissonance. Fix it fast.

Being member-first means listening—and responding. Set up feedback loops via surveys, NPS tracking, and service call reviews. Most importantly, share what you did with that feedback.

QUICK WIN: Send a quarterly "You Said, We Did" email summarizing key changes

KPI to Track: NPS movement among members who submitted feedback vs. those who didn't

Visibility builds trust. Silence kills it.

Credit unions don't lack purpose. But purpose alone doesn't differentiate anymore. To stand out today, you need systems that scale your values and prove your promise. When your messaging, member experience, and technology all say the same thing—you don't just compete. You lead.

Sign up for our monthly newsletter to receive updates.

Does any of the following sound familiar?

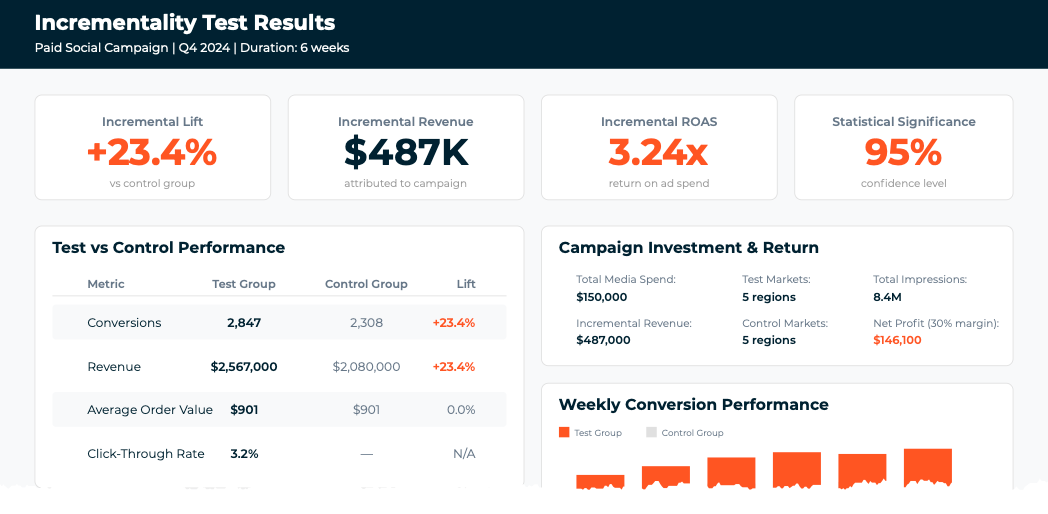

Every CMO is chasing the same question underneath all the dashboards and attribution reports: which parts of my marketing actually create new demand,...

As companies grow, they typically evolve into needing sub-brands. A sub-brand is simply a division or subsidiary of an existing brand.