How Gen Z is Changing Travel and Hospitality Marketing

According to research conducted by Hopper, Gen Z will be the next largest generation of travelers and is primed to be one of the most valuable in the...

2 min read

Kevin Smith

:

9/18/23 4:20 PM

Kevin Smith

:

9/18/23 4:20 PM

As the world becomes increasingly more digitally reliant, significant shifts in the banking industry are occurring.

78% of Americans prefer to bank digitally, while 60% say they are very or somewhat interested in using a digital bank in the next year, with the biggest push for change coming from Millennials and Gen Z.

To meet this demand, small and medium financial institutions must work to retain relevance and provide a more user-friendly experience for their consumers among large banks with bigger technology budgets.

While Millennials and Gen Z push for better digital experiences from their bank, it’s important to keep in mind that it’s not their only criteria.

Consider that these generations have grown up in a world vastly different from that of their parents and grandparents. Their economic challenges are pivotal in shaping their perspective on finance and banking.

Central to their financial history is the 2008 economic downturn. This crisis didn't just impact economies and banks; it deeply affected individual lives.

For many in these age groups, their formative years influenced their views on job stability, financial planning, and the reliability of banking institutions.

Higher education, though more accessible, came at a steep price, leading to substantial student loan debt for many.

Simultaneously, aspirations like owning a home have become more challenging due to increasingly strict lending standards and skyrocketing home prices, with home loan rates averaging 8% for a 30-year fixed mortgage.

Meanwhile, inflation, wage stagnation, and the reliance on part-time or gig work have put additional strain on the average cost of living, making saving for the future nearly impossible. It's no wonder that credit card debt is the highest it has ever been, with the average credit card charging a near-record 20.53% interest rate.

These factors have led to younger generations being less familiar with traditional personal finance practices. According to results from a MoneyLion Personal Financial Wellness Study:

This sentiment is further amplified when you consider the digital landscape they're entrenched in. The rise of platforms like TikTok or "FinTok" for financial advice signals a shift away from conventional banking advisories.

These platforms excel in providing relatable, byte-sized, and easily digestible financial advice, often from peers or individuals who share similar life experiences.

So while Gen Z and Millennials expect their financial institution to offer seamless and intuitive digital experiences, it’s not their only desire in the relationship.

They also require institutions that resonate with their experiences, offering solutions tailored to their unique challenges.

They're not just looking for a bank; they're seeking a financial ally.

Born into a digitized world and navigating economic upheavals, the younger generations' trust in traditional financial systems has eroded, leading to an overwhelming desire for financial partners that can provide genuine guidance rather than just transactional relationships.

The message for banks and other financial institutions is clear: it's no longer sufficient to merely offer a service or product.

What younger generations truly crave is a holistic approach to banking that combines technology and guidance.

They want institutions that facilitate their financial transactions and empower them with the knowledge and tools to thrive in an increasingly complex financial landscape.

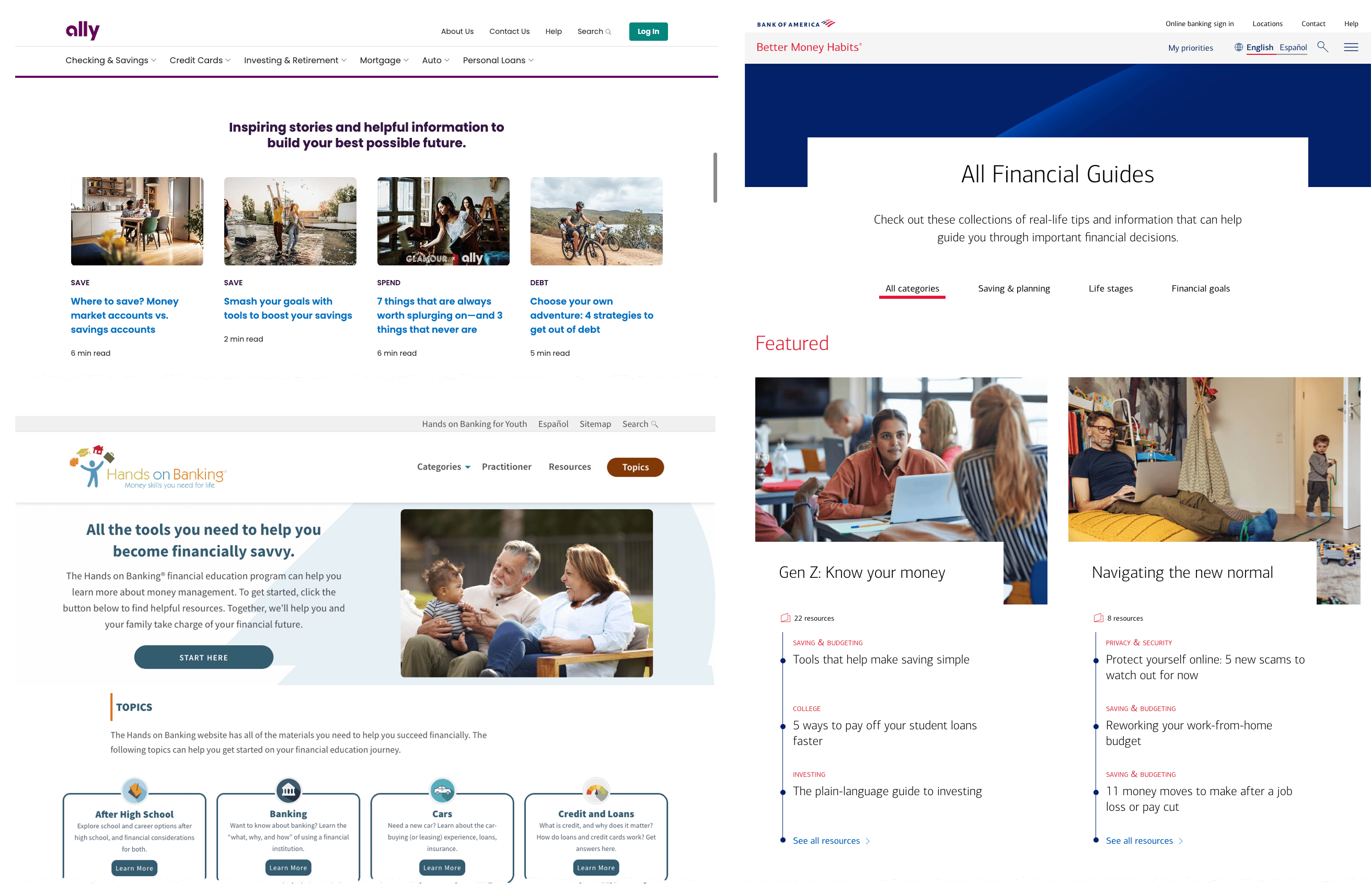

To bridge this gap, financial institutions must innovate, and not just technologically but also in their approach to guiding their members and customers.

They must evolve from service providers to financial educators and allies. Engaging with their customers on a personal level, demystifying complex financial jargon, and offering tailored advice are all crucial steps towards rebuilding the trust and confidence of Millennials and Gen Z.

Sign up for our monthly newsletter to receive updates.

According to research conducted by Hopper, Gen Z will be the next largest generation of travelers and is primed to be one of the most valuable in the...

The word brand is often misused in marketing. The confusion is likely tied to the fact that most “brands” didn’t start out thinking of themselves as...

Credit unions have always claimed to put members first. But so does everyone else now, including big banks and fintechs. In a marketplace full of...